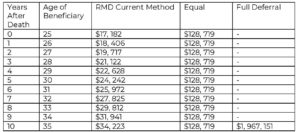

That factor is reduced by one for each succeeding distribution year.

Ira distribution table for beneficiaries.

Repeat steps 1 through 3 for each of your iras.

If you are a non spouse beneficiary of an ira whose owner has died you must take distributions from the ira every year even if you are just a year old.

Minimum distribution for this year from this ira.

When you inherit an ira as a non spouse beneficiary the account works much like a typical ira with three important exceptions.

Spouse may treat as his her own or distribute over spouse s life using table i use spouse s current age each year or distribute based on owner s age using table i.

When there are multiple beneficiaries.

No 10 penalty distributions from the account are not subject to the 10 penalty regardless of your age.

It indicates a distribution period of 18 7 years for an 80 year old.

If you are under 59 you ll be subject to the same distribution rules as if the ira had been yours originally so you cannot take distributions without paying the 10 early withdrawal penalty unless you meet one of the irs penalty exceptions.

This is the same as for a spouse beneficiary withdrawals from.

This also applies to roth iras.

Spouse beneficiaries who do not elect to roll the ira over or treat it as their own also use the single life table but they can look up their age each year.

This enables you to make contributions to the account if you are eligible e g you have earned income and are under age 70 in the case of a traditional ira to name your own beneficiaries.

Ira assets can continue growing tax deferred.

Exceptions to the 10 year distribution requirement applies to assets left to an eligible designated beneficiary.

No designated beneficiary including an estate charity or some trusts ira owner dies on or after required beginning date.

Only available if the you are the sole beneficiary.

When ira assets are inherited by several individuals each beneficiary should set up their own inherited ira by december 31 of the year following the year of death.

Designated beneficiary spouse only.

Table iii uniform lifetime age distribution period age distribution period age distribution period age distribution period 70 17 127 4 82 94 9 1 106 4 2 71 16 326 5 83 95 8 6 107 3 9 72 15 525 6 84 96 8 1 108 3 7 73 3 424 7 85 14 8 97 7.