You do not have to file one if your gift meets any of these exclusion rules but you must do so otherwise even if your gift goes over the 15 000 limit by only 10.

Gift tax exclusion tuition room board.

The education expense exclusion is limited to tuition.

If you have more than one child you re allowed to gift each of them up to that same amount.

Filing a gift tax return.

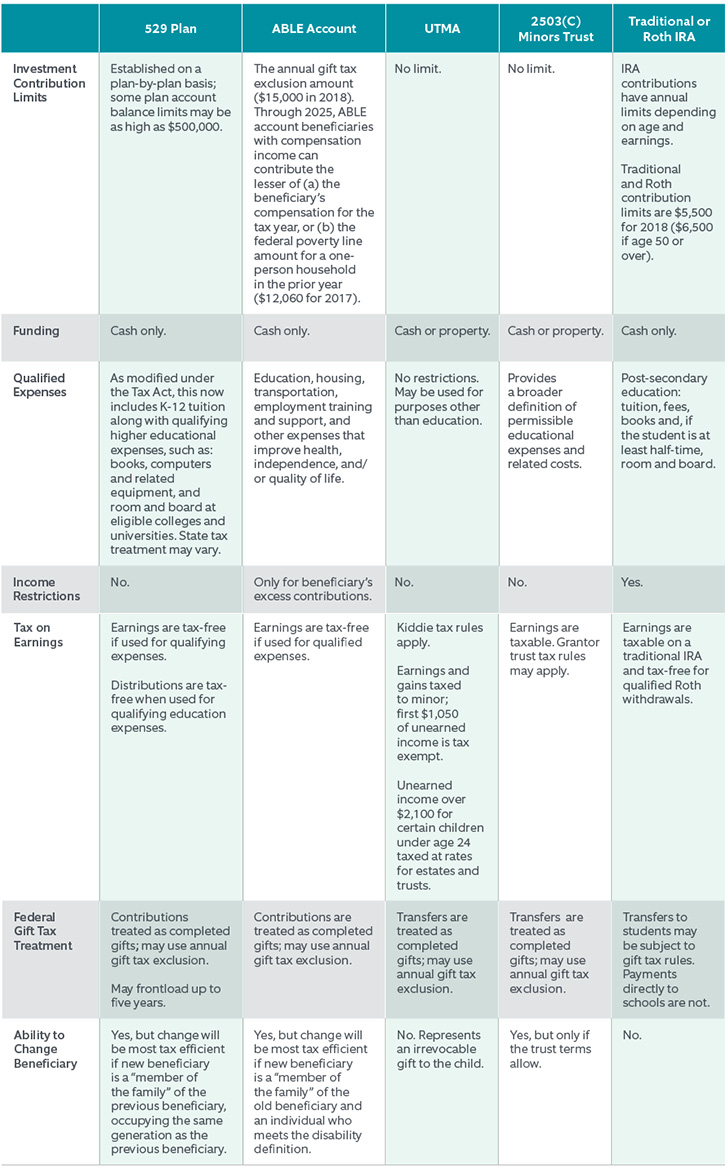

See table for computing gift tax.

It does not cover books supplies room and board or similar expenses.

The annual gift exclusion for 2019 is 15 000.

While financial gifts are subject to a federal gift tax the irs does make an exclusion in the case of financial gifts used for tuition payments.

See nonresidents not citizens of the united states later.

Gift tax returns are due simultaneously with your regular tax return form 1040.

See annual exclusion later.

Married couples also have the advantage of being able to split their gifts.

This can be an important exclusion for planning purposes.

Citizens the annual exclusion has increased to 155 000.

For 2014 the annual exclusion limit is 14 000 per person.

Tuition means the amount of money required for enrollment.

If the transfer exceeds the annual gift tax exclusion the donor may elect to use part of the donor s lifetime gift tax exclusion instead of paying gift taxes.

The education expense exemption from gift tax is limited to tuition.

The tuition gift tax exclusion only applies to tuition payments.

Payments for costs of supplies books dormitory fees or board do not qualify for the exclusion.

The exclusion called the gift tax education exclusion for tuition means that money gifted to a friend or family member to pay for college tuition is not subject to the federal gift tax.

Under section 2503 e of the internal revenue code the code tuition payments made directly to an educational organization on behalf of a person and payments for a person s medical care made directly to the provider are not treated as taxable gifts.

For both medical and tuition expense exclusions the donor must pay the medical or educational institution directly.

For purposes of the tuition expense gift tax exclusion qualifying expenses include tuition only.

Money that is gifted to a child for other college expenses such as books supplies room and board costs do not qualify for the exclusion.

The gift tax exclusion is per donor so a couple can together give twice the annual gift tax exclusion.

The annual gift tax exclusion was 14 000 in 2017 and is indexed for inflation.

That means you can give your student up to that amount directly without having to worry about paying the gift tax.

The top rate for gifts and generation skipping transfers remains at 40.

:max_bytes(150000):strip_icc()/GettyImages-956406468-87582e9ff55b4a8e88975ecc45a1afd3.jpg)